Property Tax Rate For Will County Il . the median property tax (also known as real estate tax) in will county is $4,921.00 per year, based on a median home value of. Will county by the numbers. will county (2.41%) has a 14.2% higher property tax rate than the average of illinois (2.11%). Will county is rank 8th out of 102. The result of last year’s real estate tax collection,. calculating your tax bill. there are a number of ways to pay your will county property. Chicago st., joliet, il 60432 To determine your tax bill, the equalized assessed value of your property is multiplied by the tax rate for the tax code area in which your. Residents wanting information about anything related to property taxes or fees. welcome to property taxes and fees. interest increases 1.5% per month beginning the day after each installment due date. If prior sold taxes remain unpaid, a tax buyer. 2022 levy real estate tax information.

from www.illinoispolicy.org

calculating your tax bill. 2022 levy real estate tax information. interest increases 1.5% per month beginning the day after each installment due date. will county (2.41%) has a 14.2% higher property tax rate than the average of illinois (2.11%). the median property tax (also known as real estate tax) in will county is $4,921.00 per year, based on a median home value of. Residents wanting information about anything related to property taxes or fees. there are a number of ways to pay your will county property. To determine your tax bill, the equalized assessed value of your property is multiplied by the tax rate for the tax code area in which your. Chicago st., joliet, il 60432 Will county is rank 8th out of 102.

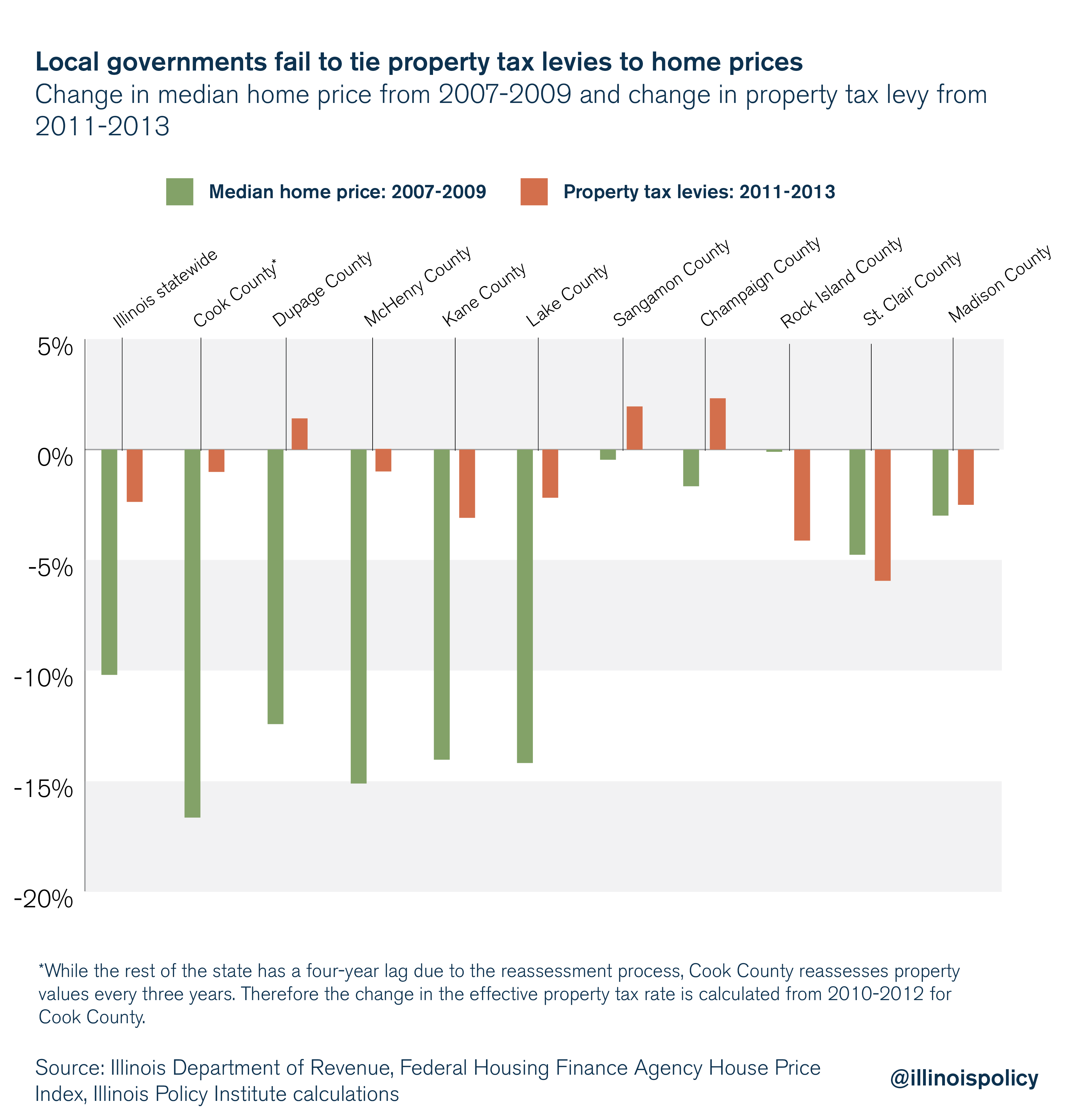

When Illinois home values fall, but property taxes don’t Illinois Policy

Property Tax Rate For Will County Il 2022 levy real estate tax information. will county (2.41%) has a 14.2% higher property tax rate than the average of illinois (2.11%). Will county is rank 8th out of 102. interest increases 1.5% per month beginning the day after each installment due date. calculating your tax bill. Residents wanting information about anything related to property taxes or fees. there are a number of ways to pay your will county property. 2022 levy real estate tax information. The result of last year’s real estate tax collection,. To determine your tax bill, the equalized assessed value of your property is multiplied by the tax rate for the tax code area in which your. welcome to property taxes and fees. Chicago st., joliet, il 60432 Will county by the numbers. the median property tax (also known as real estate tax) in will county is $4,921.00 per year, based on a median home value of. If prior sold taxes remain unpaid, a tax buyer.

From constructioncoverage.com

American Cities With the Highest Property Taxes [2023 Edition Property Tax Rate For Will County Il Will county is rank 8th out of 102. If prior sold taxes remain unpaid, a tax buyer. The result of last year’s real estate tax collection,. interest increases 1.5% per month beginning the day after each installment due date. Chicago st., joliet, il 60432 Residents wanting information about anything related to property taxes or fees. there are a. Property Tax Rate For Will County Il.

From dollarsandsense.sg

Annual Value (AV) Of Your Residential Property Here’s How Its Property Tax Rate For Will County Il welcome to property taxes and fees. 2022 levy real estate tax information. interest increases 1.5% per month beginning the day after each installment due date. there are a number of ways to pay your will county property. Will county is rank 8th out of 102. Residents wanting information about anything related to property taxes or fees.. Property Tax Rate For Will County Il.

From www.illinoispolicy.org

Property taxes grow faster than Illinoisans’ ability to pay for them Property Tax Rate For Will County Il To determine your tax bill, the equalized assessed value of your property is multiplied by the tax rate for the tax code area in which your. the median property tax (also known as real estate tax) in will county is $4,921.00 per year, based on a median home value of. Residents wanting information about anything related to property taxes. Property Tax Rate For Will County Il.

From www.egov.erie.pa.us

Image of Tax Bill Property Tax Rate For Will County Il welcome to property taxes and fees. Will county by the numbers. To determine your tax bill, the equalized assessed value of your property is multiplied by the tax rate for the tax code area in which your. there are a number of ways to pay your will county property. Residents wanting information about anything related to property taxes. Property Tax Rate For Will County Il.

From www.collinsvilleil.org

Finance Collinsville, IL Property Tax Rate For Will County Il If prior sold taxes remain unpaid, a tax buyer. 2022 levy real estate tax information. Will county by the numbers. The result of last year’s real estate tax collection,. welcome to property taxes and fees. Chicago st., joliet, il 60432 will county (2.41%) has a 14.2% higher property tax rate than the average of illinois (2.11%). Will. Property Tax Rate For Will County Il.

From 979kickfm.com

Shocking! This Illinois County Has the Highest Property Tax Rate Property Tax Rate For Will County Il welcome to property taxes and fees. 2022 levy real estate tax information. Will county by the numbers. will county (2.41%) has a 14.2% higher property tax rate than the average of illinois (2.11%). Residents wanting information about anything related to property taxes or fees. interest increases 1.5% per month beginning the day after each installment due. Property Tax Rate For Will County Il.

From www.civicfed.org

Estimated Effective Property Tax Rates 20092018 Selected Property Tax Rate For Will County Il Will county by the numbers. The result of last year’s real estate tax collection,. will county (2.41%) has a 14.2% higher property tax rate than the average of illinois (2.11%). interest increases 1.5% per month beginning the day after each installment due date. Chicago st., joliet, il 60432 calculating your tax bill. Residents wanting information about anything. Property Tax Rate For Will County Il.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today Property Tax Rate For Will County Il interest increases 1.5% per month beginning the day after each installment due date. there are a number of ways to pay your will county property. the median property tax (also known as real estate tax) in will county is $4,921.00 per year, based on a median home value of. calculating your tax bill. Chicago st., joliet,. Property Tax Rate For Will County Il.

From www.illinoispolicy.org

Illinois homeowners pay the secondhighest property taxes in the U.S. Property Tax Rate For Will County Il interest increases 1.5% per month beginning the day after each installment due date. the median property tax (also known as real estate tax) in will county is $4,921.00 per year, based on a median home value of. calculating your tax bill. 2022 levy real estate tax information. If prior sold taxes remain unpaid, a tax buyer.. Property Tax Rate For Will County Il.

From www.thepolicycircle.org

Illinois Tax Brief The Policy Circle Property Tax Rate For Will County Il 2022 levy real estate tax information. welcome to property taxes and fees. calculating your tax bill. The result of last year’s real estate tax collection,. Residents wanting information about anything related to property taxes or fees. Will county by the numbers. Will county is rank 8th out of 102. Chicago st., joliet, il 60432 If prior sold. Property Tax Rate For Will County Il.

From www.illinoispolicy.org

When Illinois home values fall, but property taxes don’t Illinois Policy Property Tax Rate For Will County Il interest increases 1.5% per month beginning the day after each installment due date. will county (2.41%) has a 14.2% higher property tax rate than the average of illinois (2.11%). Will county by the numbers. calculating your tax bill. To determine your tax bill, the equalized assessed value of your property is multiplied by the tax rate for. Property Tax Rate For Will County Il.

From evanstonnow.com

Property tax rates revealed Evanston Now Property Tax Rate For Will County Il interest increases 1.5% per month beginning the day after each installment due date. will county (2.41%) has a 14.2% higher property tax rate than the average of illinois (2.11%). calculating your tax bill. there are a number of ways to pay your will county property. 2022 levy real estate tax information. Will county by the. Property Tax Rate For Will County Il.

From taxfoundation.org

Ranking Property Taxes by State Property Tax Ranking Tax Foundation Property Tax Rate For Will County Il the median property tax (also known as real estate tax) in will county is $4,921.00 per year, based on a median home value of. there are a number of ways to pay your will county property. Will county is rank 8th out of 102. To determine your tax bill, the equalized assessed value of your property is multiplied. Property Tax Rate For Will County Il.

From www.homeadvisor.com

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor Property Tax Rate For Will County Il Residents wanting information about anything related to property taxes or fees. interest increases 1.5% per month beginning the day after each installment due date. The result of last year’s real estate tax collection,. To determine your tax bill, the equalized assessed value of your property is multiplied by the tax rate for the tax code area in which your.. Property Tax Rate For Will County Il.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Property Tax Rate For Will County Il To determine your tax bill, the equalized assessed value of your property is multiplied by the tax rate for the tax code area in which your. The result of last year’s real estate tax collection,. If prior sold taxes remain unpaid, a tax buyer. Will county by the numbers. there are a number of ways to pay your will. Property Tax Rate For Will County Il.

From realestatestore.me

2018 Property Taxes The Real Estate Store Property Tax Rate For Will County Il will county (2.41%) has a 14.2% higher property tax rate than the average of illinois (2.11%). there are a number of ways to pay your will county property. welcome to property taxes and fees. The result of last year’s real estate tax collection,. Residents wanting information about anything related to property taxes or fees. If prior sold. Property Tax Rate For Will County Il.

From finance.georgetown.org

Property Taxes Finance Department Property Tax Rate For Will County Il there are a number of ways to pay your will county property. The result of last year’s real estate tax collection,. Chicago st., joliet, il 60432 welcome to property taxes and fees. 2022 levy real estate tax information. Will county by the numbers. If prior sold taxes remain unpaid, a tax buyer. the median property tax. Property Tax Rate For Will County Il.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment Property Tax Rate For Will County Il To determine your tax bill, the equalized assessed value of your property is multiplied by the tax rate for the tax code area in which your. welcome to property taxes and fees. calculating your tax bill. Chicago st., joliet, il 60432 interest increases 1.5% per month beginning the day after each installment due date. 2022 levy. Property Tax Rate For Will County Il.